35+ Refi mortgage calculator with taxes

Best Mortgage Refi Lenders. 2018 State Local Property Taxes Per Capita.

Reverse Mortgage Calculator Mls Mortgage Reverse Mortgage Mortgage Amortization Calculator Mortgage Payment Calculator

Fidelity estimates that someone earning 50000 per year can expect Social Security to replace 35 of their income.

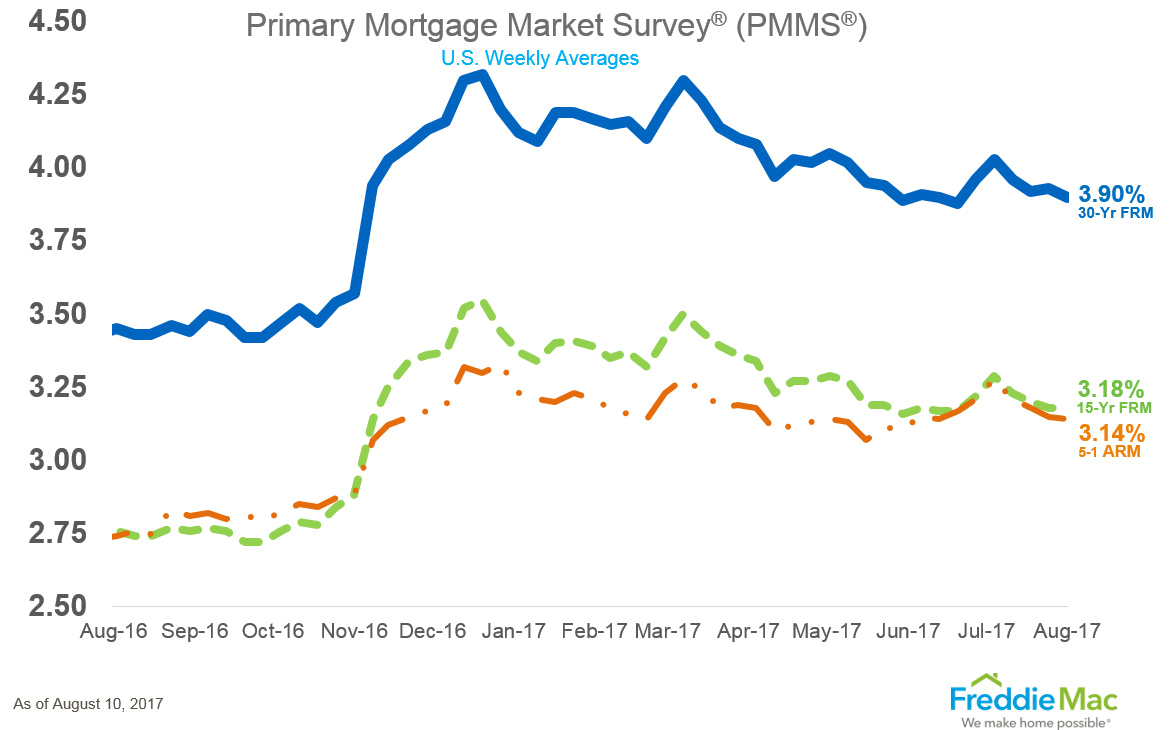

. You can include expenses such as real estate taxes homeowners insurance and monthly PMI in addition to your loan amount interest rate and term. The Freddie Mac Primary Mortgage Market Survey for October 8 2020 stated the average 30-year fixed-rate mortgage charges 287 with 08 fees points. Mortgages originated before 2018 will remain grandfathered into the older limit mortgage refinancing of homes which had the old limit will also retain the old limit on the new refi loan.

Best Mortgage Refi Lenders. WHat is the fomula to calculate a interest only loan. Use SmartAssets free North Carolina mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more.

A 15-year FRM has 180 payments spread throughout 15 years. Mortgage discount points explained January 13 2022 You Dont Need A 20 Downpayment To Buy A Home February 20 2019 First Time Home Buyer. Use SmartAssets free Texas mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more.

Use SmartAssets free Florida mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. Home buyers who have a strong down payment are typically offered lower interest rates. If you have built up a lot of equity in your primary residence maximizing your retirement portfolio may be difficult with the payout limits of government-insured reverse.

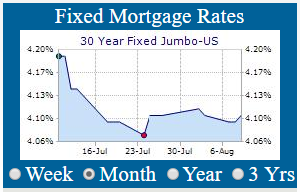

Refinancing rates moved similarly Thursday with the 30-year refi average plunging 38 basis points the 15-year losing 28 points and Jumbo 30-year refi rates remaining flat. 19 thoughts on Extra Payment Calculator. Start by entering the mortgage amount.

On the other hand 13. 71 ARM refi. 15-Year Vs 30-Year Mortgage Calculator.

Actual payments will be higher with taxes and insurance. About 28 percent of sellers agents said they staged a house before listing them for sale. Beneath the mortgage rate table we offer an in-depth guide comparing conforming.

Next using the exponent function on your calculator or in Excel raise that figure 150 to the power of 13 the denominator represents the number of years 3. The above calculator is for fixed-rate mortgages. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week.

If you pay for the points upfront with other closing costs and put 20 down on a home priced at the 2019 average you would need to save 76780 while obtaining a loan for 307120. Todays national mortgage rate trends. Thankfully this Mortgage Payment Calculator helps you figure out your total monthly mortgage payment and print a complete amortization schedule for your records.

This is the percentage of your earnings that pay for your housing-related costs together with your other debts. Back-end DTI ratio The back-end DTI limit for USDA loans should not exceed 41. The AAG Advantage Jumbo Reverse Mortgage.

We also add in the cost of property taxes mortgage insurance and homeowners. 71 ARM refi. 15 yr jumbo fixed mtg refi.

If you have 30 years or more of covered. We also add in the cost of property taxes mortgage insurance and homeowners fees using loan limits and figures based on your location. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

It includes monthly mortgage payments property taxes homeowners insurance etc. 47 followed by the master bedroom 42 and the kitchen 35. But someone earning 300000 per year would have.

15 yr fixed mtg refi. Use this calculator to estimate your monthly home loan payments for a conforming conventional home loan. Homeowners who put less than 20 down on a conventional loan also have to pay for property mortgage insurance until the loan balance falls below 80 of the homes valueThis insurance is rolled into the cost of the monthly home loan.

Additional restrictions may. Across the United States 88 of home buyers finance their purchases with a mortgage. Census Bureau 2019 American Community Survey.

While a married couple could sell it for as much as 840000 without incurring any taxes. Adjustable Rate Mortgage ARM Low DownCash Out Mortgage. We also publish current Redmond conventional loan rates beneath the calculator to help you compare local offers and find a lender that fits your needs.

The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. To deduct mortgage insurance premiums from their taxes in some. The Early-2017 Guide to Buying a Home March 10 2017.

Actual payment could include other amounts such as escrow for insurance and property taxes private mortgage insurance PMI fees and dues. Meanwhile for a 30-year FRM there are 360 payments spread across 30 years. Existing Mortgage Payoff.

The mortgage interest deductibility limit was also lowered from the interest on 1 million in debt to the interest on 750000 in debt. The quickest way to understand if the WEP affects you is to look at how many years you paid Social Security taxes before you landed the pension-earning job. 15 yr jumbo fixed mtg refi.

DCs rank does not affect states ranks but the figure in parentheses indicates where it would rank if included. This is the cost of the home minus the down payment. We also add in the cost of property taxes mortgage insurance and homeowners fees using loan limits.

The most common home loan term in the US is the 30-year fixed rate mortgage. Rates and terms are subject to change at any time and without notice. You can use the above calculator to generate a sample amortization schedule.

For example lets say youre considering purchasing a 250000 home and putting 20 percent down. In many countries 25-year mortgages are structured as adjustable or variable rate loans which reset annually after a 2 3 5 or 10 year introductory period with a teaser rate. Trying to pay it off 1112015.

As a result the data exclude property taxes paid by businesses renters and others. Assuming you always pay on time your mortgage should be paid off within the agreed term. The AAG Advantage Jumbo Reverse Mortgage is AAGs privately offered reverse mortgage intended exclusively for owners of high-value homes.

2016 when the upfront guarantee. 1 and an annual mortgage insurance fee of 035 of the loan amount paid monthly.

Monthly Amortization Schedule Excel Download This Mortgage Amortization Calculator Template A Amortization Schedule Mortgage Amortization Calculator Mortgage

Fixed Vs Arm Mortgage Calculator Mls Mortgage Arm Mortgage Amortization Schedule Mortgage Amortization Calculator

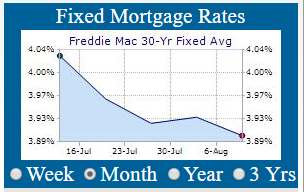

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Mortgage Calculator

Amp Pinterest In Action In 2022 Amortization Chart Amortization Schedule Mortgage Amortization Calculator

Refinance Mortgage Calculator Mls Mortgage Refinance Mortgage Home Refinance Free Mortgage Calculator

Trulia Mortgage Center Goes Live Agbeat Mortgage Payment Calculator Mortgage Mortgage Amortization Calculator

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

How Much House Can I Afford Buying First Home Mortgage Marketing Home Buying Process

Fha Home Loan Calculator Easily Estimate The Monthly Fha Mortgage Payment With Taxes Mortgage Loan Calculator Fha Mortgage Mortgage Amortization Calculator

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

Mortgage Calculator Monthly Payments Screen Mortgage Loan Calculator Mortgage Payment Calculator Mortgage Loan Originator

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Handy Home Blog Calculating How Much You Can Afford To Spend On A Mortgage Payment Buying First Home Home Buying Tips Home Buying

Download Microsoft Excel Mortgage Calculator Spreadsheet Xlsx Excel Loan Amortizatio In 2022 Mortgage Amortization Calculator Amortization Schedule Amortization Chart

Home Equity Loan Calculator Mls Mortgage Home Equity Loan Calculator Home Equity Loan Mortgage Amortization Calculator